Some of the most important automotive markets in Europe, France, Italy and Spain, are starting 2024 successfully, with registration figures showing a significant increase in February. The figures show that the national markets continue to perform well despite the challenges of past years and show no signs of slowing down. While France is seeing interest in all types of powertrains, both Italy and Spain are seeing petrol-powered cars and hybrids increasingly driving their markets.

Impetus for electric vehicles (BEVs) in France

According to data from the Filière Automobile & Mobilités (PFA), the French automotive market recorded a 13% increase in new car registrations in February. This was the best result among the three main European markets for the month. France also showed diversity in the choice of powertrains. Registrations of vehicles with petrol engines rose by only 2% year-on-year, following a drop in deliveries in January. At the same time, with diesel vehicle registrations down significantly by 30.5% during the month, the internal combustion engine (ICE) market recorded 5.7% fewer registrations.

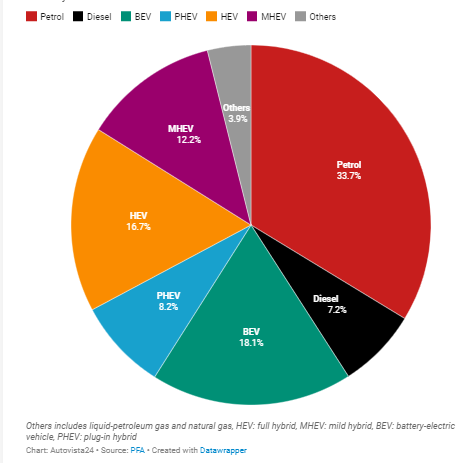

The decline in the popularity of diesel in most European markets affected registrations of internal combustion engine (ICE) vehicles. However, most of the lost share has been offset by an increase in registrations of petrol engine vehicles. France is currently experiencing a turning point, with electric models gaining an advantage over combustion engine vehicles. This trend has been further highlighted by the registration results of electrically powered vehicles (BEVs). Their number increased by 31.9% compared to February 2023. They have become the second most popular choice in the country. Although there is still a gap between all-electric vehicles and those with petrol engines, it is smaller than in January, with BEV registrations outnumbering petrol engine registrations by half. In terms of market share, petrol accounted for 33.7% in February, down 3.6 percentage points on the previous year. The share of pure electric vehicles (BEVs) rose to 18.1%, an increase of 2.6 percentage points compared to the same month last year. It appears that this technology is gaining popularity in France.

Fully hybrid (HEV) models also recorded an increase last month, up 28.8% year-on-year. Nevertheless, this was not enough to keep this powertrain in second place. Despite this, HEV market share increased by two percentage points to 16.7%. French figures also show a growing interest in mild hybrids (MHEVs), which offer electric support for combustion powertrains but do not have their own electric range. Registrations of these vehicles increased by 63.7% during the month and a market share of 12.2%. The plug-in hybrid (PHEV) market rebounded after a weak performance in January. Registrations increased by 11.9% year-on-year. Despite this, the technology remains the weakest powertrain in the mainstream, outside the ‘other’ category. It lost 0.1 percentage points of market share during the month, placing it at 8.2% of the total.

French figures from the beginning of the year show similar trends to February, with the combined results for the first two months of 2024 showing that deliveries of petrol vehicles fell by 0.7%, while electric vehicles (BEVs) moved into second place with a 33.9% increase in deliveries. The market may be witnessing a shift in the dominance of the single powertrain, with no single technology playing a significant role in total registrations.

The share of petrol cars in Italy is growing

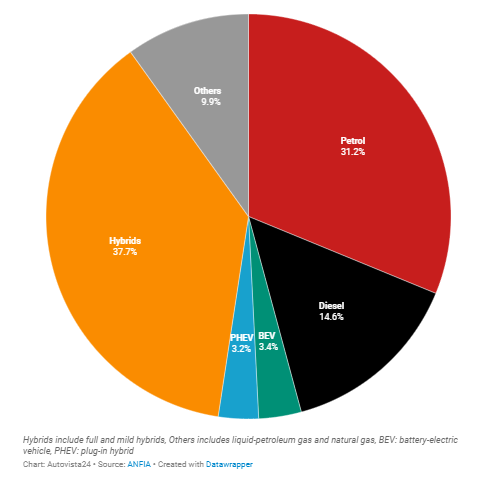

The Italian car market is seeing growth in the petrol segment. According to the latest figures from the Italian automotive authority ANFIA, new car registrations in Italy rose by 12.8% in February. Italy has been betting on hybrid powertrains for a long time, with ANFIA combining both HEVs and MHEVs in this category. This trend also continued in February, with hybrid deliveries up 16.1%.

In contrast to France, however, petrol engines saw an increase in popularity in February. Their numbers increased by 33.4% last month, although 45,901 registrations were less than 10,000 units less than hybrids. However, this growth also translated into a significant increase in market share, which stood at 31.2%, compared to 26.4% in the same period last year. In the case of diesel engines, registrations fell by 11.8% and their market share decreased to 14.6%. Nevertheless, the 21,455 units delivered were still higher than in other major European markets, with the exception of Germany. Petrol performance contributed to an improvement in the overall internal combustion engine (ICE) market share, although only by 0.7 percentage points, reaching 45.8%.

Unlike the French market, Italy is largely a two-drive country, with hybrids and petrol models in the lead. This has a negative impact on the electric vehicle (EV) market, where BEV and PHEV models are struggling. Only 5,007 all-electric passenger cars were registered in February. This represents an increase of 3.1 per cent year-on-year, but the share of this type of propulsion was only 3.4 per cent of the total market, a decrease of 0.3 percentage points. PHEVs had an even more difficult time. Their registrations fell by 16.6% to 4,662 deliveries. Their market share was 3.2%, down from last year’s 4.3%. Total deliveries of electric vehicles in February fell by 7.4%, accounting for just 6.6% of all registrations.

In the first two months of the year, hybrid registrations increased by 15.2%, while petrol recorded an increase of 30.1%. Despite a 10.2% drop in diesel vehicle registrations in 2024, internal combustion engine (ICE) registrations increased by 13.4% overall. BEVs have struggled so far, with deliveries down 2.7%, while PHEVs recorded a 25.2% decline. Overall, electric vehicle registrations were up 43% in January and February. ANFIA hopes that the situation with electric vehicles will improve following the publication of the Italian Prime Minister’s new decree, which includes incentives to renew the country’s car fleet and plans to help reduce CO2 emissions. Until the new law comes into force, the market remains in limbo as those who are considering purchasing an electric vehicle wait for better incentives to buy.

Spain faces stagnation in registration numbers

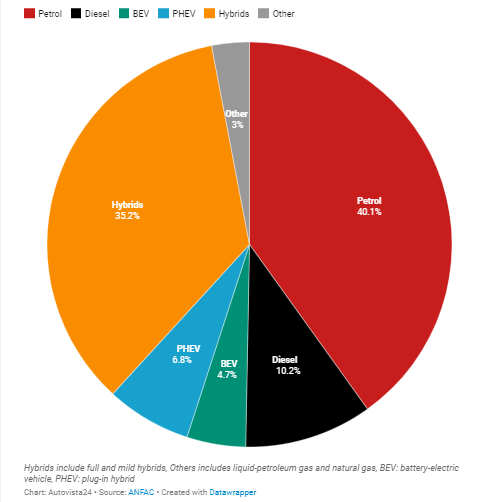

There is cautious optimism in the Spanish automotive market, after a 9.9% increase in registrations, reported by ANFAC, extended a series of positive figures in the country to the 14th month. However, the electric vehicle market in Spain remains at a low level. The authorities have stressed the need to increase registrations in order to surpass the one million new car barrier in 2024.

The majority of passenger cars registered were petrol vehicles (40.1%).However, as in France, the market for this type of fuel appears to be slowing down. The percentage of units delivered increased by only 3.7% compared to last year.Despite this improvement, the market share of petrol vehicles fell from 42.6% in February 2023, suggesting a potential cooling of interest.

The largest increase was in the hybrid market, which includes HEVs and MHEVs, up 26.6% year-on-year.This means that hybrid drives accounted for 35.2% of the market, up from 30.6% a year earlier. Thus, another country is targeting a less diverse industry, relying on two main powertrains. Spain is trying to encourage buyers to purchase electric vehicles.

Thus, another country is targeting a less diverse industry, relying on two main powertrains. Spain is trying to encourage buyers to purchase electric vehicles.Both BEVs and PHEVs saw improvements during the month, with all-electric powertrains up 15.4%.However, this improvement only equates to a 4.7% market share. PHEVs saw an increase of 15.6% in February and accounted for 6.8% of market share.

For this reason, PHEVs remain the most popular plug-in powertrain in Spain, which poses a problem for the country in terms of reducing CO2 emissions from vehicles.It is PHEVs and HEVs, which continue to emit greenhouse gas, that should gradually reduce the country’s average CO2 emissions, in anticipation of the maturity of the BEV market.