Nearly 70% of new cars will be sold directly through online platforms. This is according to the 24th edition of KPMG’s report entitled. ‘Global Automotive Executive Survey’, which outlines the leading trends in the automotive industry worldwide.

For many decades, the automotive industry has been one of the key sectors of the European economy, generating almost 7% of the region’s GDP and being directly or indirectly responsible for almost 14 million jobs, or 6% of employment in the region. More than 17,000 companies operate in it, including suppliers at all levels, according to the McKinsey analysis. What’s more, nearly 30 per cent of the world’s automotive patents come from European countries, and the value of the top 10 European automotive companies reaches €200 billion. Half of these are the world’s most valuable brands. Of particular importance is the German automotive industry, whose representatives have for many years been recognised as global industry leaders.

The European automotive industry: the challenges of digital transformation

Recently, the European industry has been experiencing a decline in competitiveness in the global market. As a symbol of this phenomenon, the German industry lost its first place in the world in terms of the number of passenger cars and light commercial vehicles exported in 2022. China boasted exports of 3 million vehicles, while Germany exported 2.6 million. Analysis by the McKinsey Center for Future Mobility shows that as of 2019, European manufacturers have lost six percentage points in domestic market share and five percentage points in China. Meanwhile, Chinese manufacturers gained 45 per cent domestic market share in 2022 and increased their market share in Europe by as much as eight times, albeit from a low level, between 2020 and 2022.

The automotive industry in Europe is facing challenges, among which the digitisation of sales and customer contact plays a key role. According to an analysis of available sources, European carmakers need to catch up in this area to meet growing consumer expectations.

According to the report, the European buyer of new cars is a representative of the less digitalised generation, with an average age of 58, while new players in the market, especially from China, are better adapted to the needs of digital consumers, the so-called ‘digital natives’. In the European automotive industry, only 20% of R&D professionals have the required digital competences, which is at least twice as low as for new electric manufacturers.

The need for digitalisation in the automotive industry

The automotive industry must therefore intensify its efforts to digitise sales and customer contact. As experts point out, sales and distribution methods in Europe are currently outdated and rely on the traditional dealer network. Meanwhile, the growth of e-commerce and the digitalisation of the automotive industry are translating into increasing expectations from consumers who want easier access to purchase parts and services online.

A comprehensive restructuring of the European automotive industry is therefore necessary, involving not only the modernisation of technology, but also the adaptation of sales and distribution models to the needs of the digital customer. Only in this way will European manufacturers be able to compete effectively with new market players, such as Chinese electric car manufacturers, who are rapidly gaining market share in Europe.

Online car sales trend: the future of motoring

According to estimates from the automotive industry, by 2030 almost seven out of ten new cars will be sold directly through online platforms or by car manufacturers.

Key drivers of this trend are the growing popularity of online shopping and the desire of manufacturers to increase control over the sales process and customer relationships. This shift in the car distribution model is expected to have a significant impact on the entire automotive ecosystem.

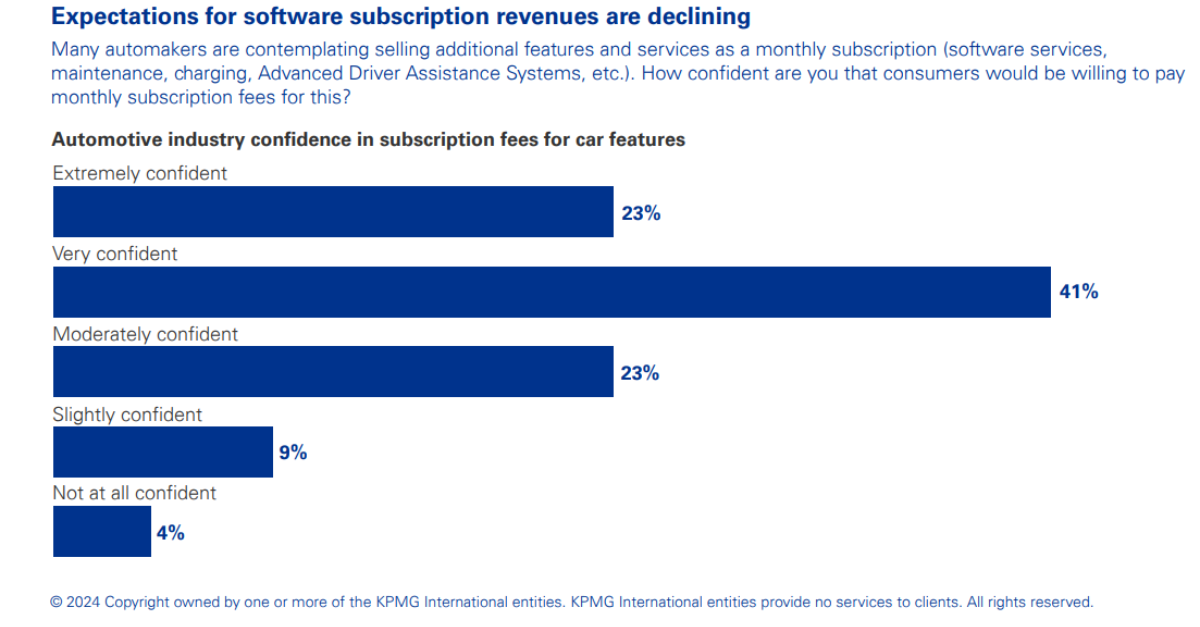

Many car manufacturers are already considering selling additional features and services through monthly subscription plans.